Cost Concept and Classification

PERIOD COSTS Factory Sales Administration. 2-3 A product cost is any cost involved in purchasing or manufacturing goods.

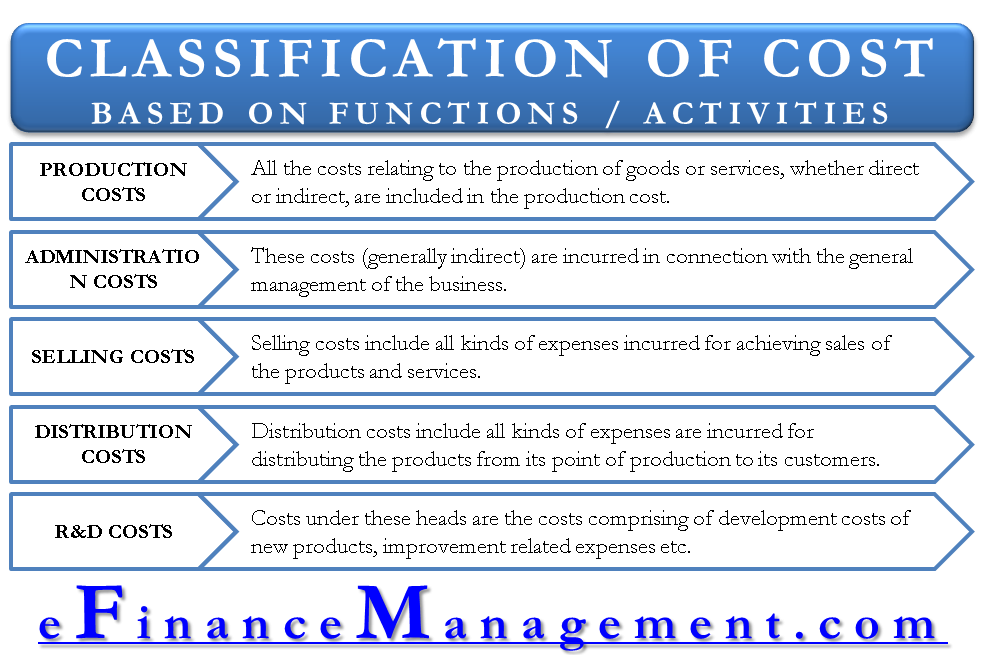

What Is Classification Of Cost Definition Explanation And Examples

AND CLASSIFICATIONS LEARNING OBJECTIVES Explain the relationship between financial accounting and cost accounting.

. Cost Concepts Classification 2. COST TERMS CONCEPTS AND COST TERMS CONCEPTS AND CLASSIFICATIONS AN OVERVIEW OF COST TERMS. This classification is based on the degree of traceability to.

Cost monetary amount of the resources given up or sacrificed to attain some objectives such as acquiring goods and. If we buy from C. 3 Classification by Traceability.

COST CONCEPTS CLASSIFICATIONS AND BEHAVIOR. Costs classified as to variability High-low point method It is a quantitative approach that starts with the collection of data pertaining to the cost to be analyzed. Properly account for labor costs associated with idle time.

I hope at the end of the article you have a basic idea about the Cost Terms Concepts and. Understand the concept of cost. A sells the raw materials for P100 per kilo B sells the raw materials for P120 per kilo and C sells the raw materials for P130 per kilo.

Conversion costs Direct manufacturing labor costs Manufacturing overhead costs. It can be on a weekly monthly. Cost Concept and Classification.

This aspect one of the most important classification of costs into direct costs and indirect costs. State the importance of cost classification. Concept of cost It is the amount of expenditure incurred or attributable to a given thing It is the measurement in monetary terms of the.

Value foregone or sacrifice of resources for the purpose of achieving some economic benefit which will promote the profit-making ability of. Differential costs opportunity costs and sunk costs. Define and give examples of cost classifications used in making decisions.

Cost classify according to natural characteristics. Up to 3 cash back COST CONCEPTS. In the case of manufactured goods these costs consist of direct materials direct labor and manufacturing.

Distinguish between cost expenses and losses. We have three suppliers - A B and C.

Different Types Of Popular Costing Managerial Accounting Accounting Accounting Education

Describes Job Order Costing Managerial Accounting Accounting Basics Accounting Student

No comments for "Cost Concept and Classification"

Post a Comment